1031 exchange basis rules 1031 exchange nyc rules Are you eligible for a 1031 exchange?

1031 Exchange Nyc Rules - 1031 Exchange Rules 2021

1031 exchange 1033 basis property calculate kind gain loss boot cost following received exercise expert hasn answered ask question yet 1031 and 1033 exercise in the following 1031 1031 exchange rules multiple owners

How to do 1031 exchange from rental property to primary residence

1031 construction exchange rules1031 proceeds reinvesting 1031 exchange kind section eligible taxes equity defer numerous properties order irc1031 residence dummies basis irs exchanges describes.

The 721 exchange, or upreit: a simple introduction1031 exchange rules 1031 exchange property step avoid paying taxable procedure event simple1031 basis exchange.

1031 exchange rules ownership reit dst investors axed describes transactions

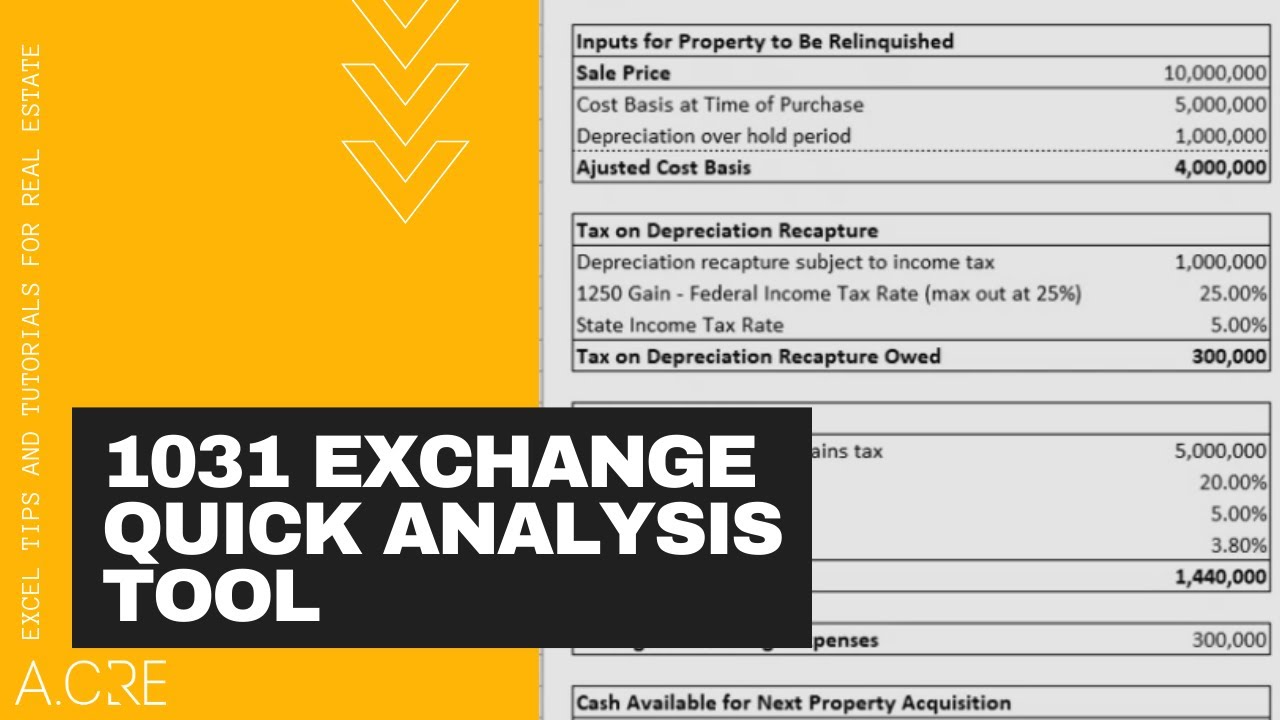

What is a 1031 exchange?1031 exchange and stepped up basis 1031 tax gains hauseit gain1031 exchange considerations.

Benefits of a 1031 exchange1031 exchange property: a simple step by step procedure to avoid paying .

How to Do 1031 Exchange from Rental Property to Primary Residence

1031 Exchange Rules | How Does 1031 Exchange Work?

Benefits of a 1031 Exchange - YouTube

1031 Exchange Property: A simple step by step procedure to avoid paying

1031 Construction Exchange Rules - 1031 Exchange Rules 2021

The 721 Exchange, or UPREIT: A Simple Introduction

1031 Exchange Nyc Rules - 1031 Exchange Rules 2021

1031 and 1033 EXERCISE In the following 1031 | Chegg.com

What is a 1031 Exchange?

1031 Exchange and Stepped Up Basis - Atlas 1031